California State University, Northridge proudly promotes career and professional development for employees - particularly through the University’s Fee Waiver and Reduction Program. This program allows eligible employee members to “learn while they earn,” and attend classes at CSUN or other CSU campuses for greatly reduced rates. CSUN employees who want to complete a bachelor’s or graduate degree, enhance job skills, or even prepare for a future career, are encouraged to participate in this program. We would love to have you join the more than 1,400 members of CSUN's "Home Grown" community of current employees who have earned a degree from CalState Northridge!

Eligible staff, faculty, and management state employees may have tuition and fees for a maximum of two (2) courses or six (6) units, whichever is greater, waived/reduced each semester. Fees are waived only for classes offered in the Fall Academic Semester, the Spring Academic Semester, and State Supported classes offered during Summer Sessions. All classes must be taken for grades or credit/no credit. Enrollment in the Fee Waiver and Reduction program does not apply to self-supported programs, including enrollment in the Tseng College of Extended Learning. In addition to the employee fee waiver, eligible CSU employees may transfer his or her fee waiver benefit entitlement to a spouse, domestic partner or dependent child.

Employees taking courses for personal enrichment are encouraged to explore the option of enrolling in courses for credit/no credit to avoid GPA impact that could lead to Academic Probation or Disqualification. Good academic standing applies for participation in the fee waiver benefit.

Participation in the CSU Fee Waiver program by an employee entitles the employee to instructional services, but not student services including student health services. Participation in the CSU Fee Waiver program by a spouse, domestic partner, or dependent child of an employee entitles the spouse, domestic partner, or dependent child to utilize all services provided to other CSU students including, but not limited to, student health services.

Should you separate from CSUN before census date of the semester, you will no longer be eligible for the benefit, the fee waiver will be removed from your account and you can complete your course(s) by paying the fees due or drop the course(s). Should you separate from CSUN after census date, you can continue to use the fee waiver to cover that semester.

Note: For priority processing, submit your Spring 2025 Fee Waiver & Reduction Program Application between Monday, October 7, and Friday, November 8, 2024.

Partnering with the Office of the Registrar and Student Accounting, we will be offering a workshop on the Fee Waiver & Reduction Program Tuesday, October 15, 2024 from 12:00 – 1:00 pm. You can learn more and register here. (If you are unable to join us, a video of a previous session is available below.)

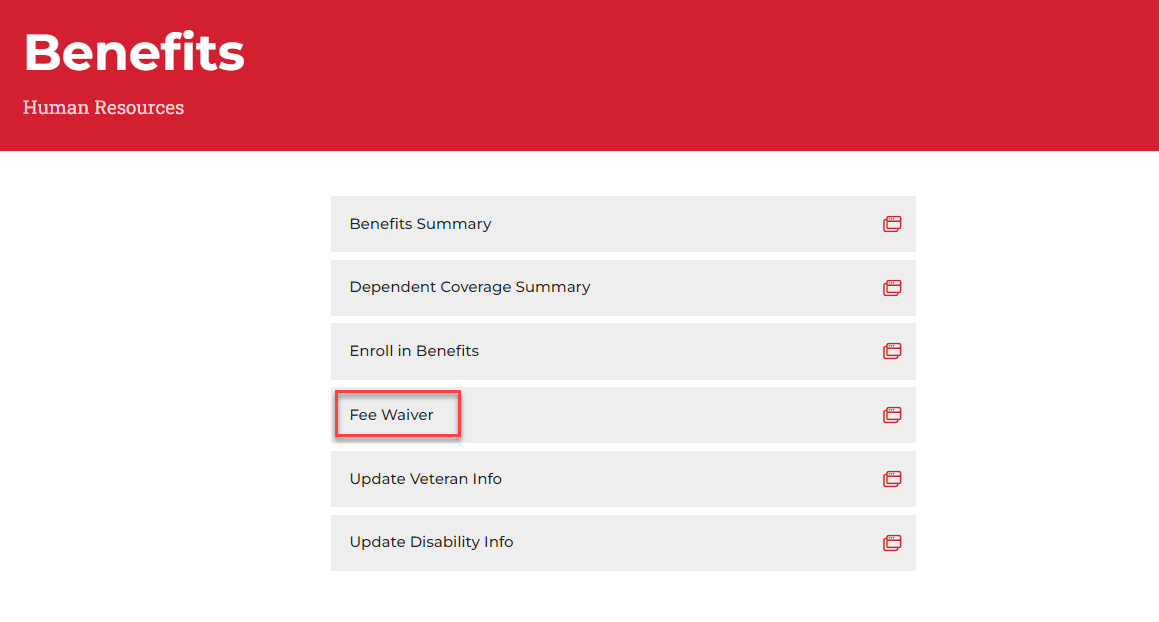

For more details on the Fee Waiver & Reduction Program, and to determine eligibility, please review the following information. If you have additional questions, please contact CSUN Fee Waiver at feewaiver@csun.edu.